What is that pig? It's from Tanta's Excel Art. A Mortgage Pig™ exclusive.

Raindrops Keep Falling on My Pig Warning: this is a large (2 MB) Excel File.

And yes, the Mortgage Pig™ is wearing lipstick.

Happy New Year to All!

The following are some excerpts (with graphs) from a few housing posts in December. Follow the link for the entire post.

From Homeowners With Negative Equity

The

following graph shows the number of homeowners with no or negative

equity, using the most recent First American data, with several

different price declines.

Click on graph for larger image.

Click on graph for larger image.At

the end of 2006, there were approximately 3.5 million U.S. homeowners

with no or negative equity. (approximately 7% of the 51 million

household with mortgages).

By the end of 2007, the number will have risen to about 5.6 million.

If prices decline an additional 10% in 2008, the number of homeowners with no equity will rise to 10.7 million.

The last two categories are based on a 20%, and 30%, peak to trough declines.

From: Home Builders and Homeownership Rates

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year.

The graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.The reasons for the change in homeownership rate will be discussed [see here],

but here are two key points: 1) The change in the homeownership rate

added about half a million new homeowners per year, as compared to a

steady homeownership rate, 2) the rate (red arrow is trend) appears to

be heading down.

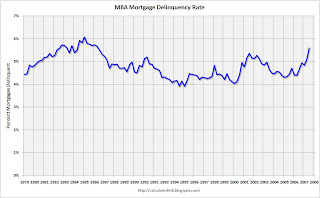

From: MBA Mortgage Delinquency Graph

Here is a graph of the MBA mortgage delinquency rate since 1979.

Here is a graph of the MBA mortgage delinquency rate since 1979.This

is the overall delinquency rate, and it is at the highest rates since

1986. As noted earlier this morning, delinquencies are getting worse in

every category - including prime fixed rate mortgages - and getting

worse at a faster rate in every category.

NOTE on 12/31/2007: See: Defaults on Insured Mortgages Reach Record

From: Housing Inventory and Rental Units

Renting is a substitute for owning, and to understand the current

excess housing inventory, we also need to consider rental units.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

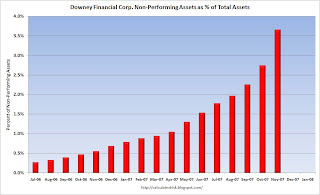

From: Downey Financial Non-Performing Assets

From the Downey Financial 8-K released on Dec 14th.

From the Downey Financial 8-K released on Dec 14th.This would be a nice looking chart, except those are the percent non-performing assets by month.

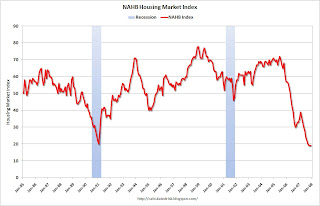

From: NAHB: Builder Confidence Unchanged at Record Low

The NAHB reports that builder confidence was unchanged at a record low 19 in December.

The NAHB reports that builder confidence was unchanged at a record low 19 in December.NAHB: Builder Confidence Remains Unchanged For Third Consecutive Month

Builder

confidence in the market for new single-family homes remained unchanged

for a third consecutive month in December as problems in the mortgage

market and excess inventory issues continued, according to the latest

NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI

held even at 19 this month, its lowest reading since the series began

in January 1985.

From: Single Family Starts Fall to Lowest Level Since April 1991

Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.Look

at what is about to happen to completions: Completions were at a 1,344

million rate in November, but are about to follow starts to below the

1.2 million level. I'd expect completions to fall rapidly over the next

few months, impacting residential construction employment.

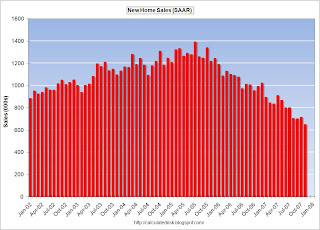

From: November New Home Sales

According to the Census Bureau report,

New Home Sales in November were at a seasonally adjusted annual rate of

647 thousand. Sales for October were revised down to 711 thousand, from

728 thousand. Numbers for August and September were also revised down.

From: More on New Home Sales

This

Thisgraph shows New Home Sales vs. Recession for the last 35 years. New

Home sales were falling prior to every recession, with the exception of

the business investment led recession of 2001.

This is what we call Cliff Diving!

And this shows why so many economists are concerned about a possible consumer led recession - possibly starting right now.

From: November Existing Home Sales

The graph shows the Not Seasonally Adjusted (NSA) sales per month for

the last 3 years. Note that on an NSA basis, November sales were

slightly below October.

The impact of the credit crunch is

obvious as sales in September, October and November declined sharply

from earlier in the year.

For existing homes, sales are reported

at the close of escrow. So November sales were for contracts signed in

September and October.

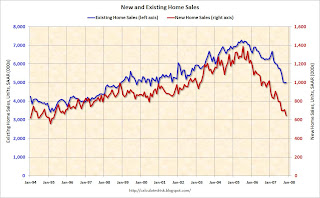

From: More on November Existing Home Sales

Click on graph for larger image.

Click on graph for larger image. This

graph shows the seasonally adjusted annual rate of reported new and

existing home sales since 1994. Since sales peaked in the summer of

2005, both new and existing home sales have fallen sharply.

Ignoring the occasional month to month increases, it is clear that sales of both new and existing homes are in free fall.

The

Thesecond graph shows the annual sales and year end inventory since 1982

(sales since 1969), normalized by the number of owner occupied units.

This shows the annual variability in the turnover of existing homes,

with a median of 6% of owner occupied units selling per year.

Currently

6% of owner occupied units would be about 4.6 million existing home

sales per year. This indicates that the turnover of existing homes -

November sales were at a 5.0 million Seasonally Adjusted Annual Rate

(SAAR) - is still above the historical median.

This suggests sales will fall much further in 2008.

Powered by ScribeFire.

No comments:

Post a Comment